Interest Rates Explained

If you are into data & trends - this is for you 🤓

It’s no secret that it’s the wild west out there when it comes to mortgage interest rates. There is a lot of speculation on what will happen based on a few variables.

The main variable being the federal reserve rate.

But first…. Let’s gain some clarity.

The Federal Reserve is the nation's central bank. It guides the economy with the twin goals of encouraging job growth while keeping inflation under control. Its main job is to conduct the nation's monetary policy by influencing money and credit conditions in the economy in pursuit of full employment and stable prices.

…influencing money + credit conditions in the economy…..

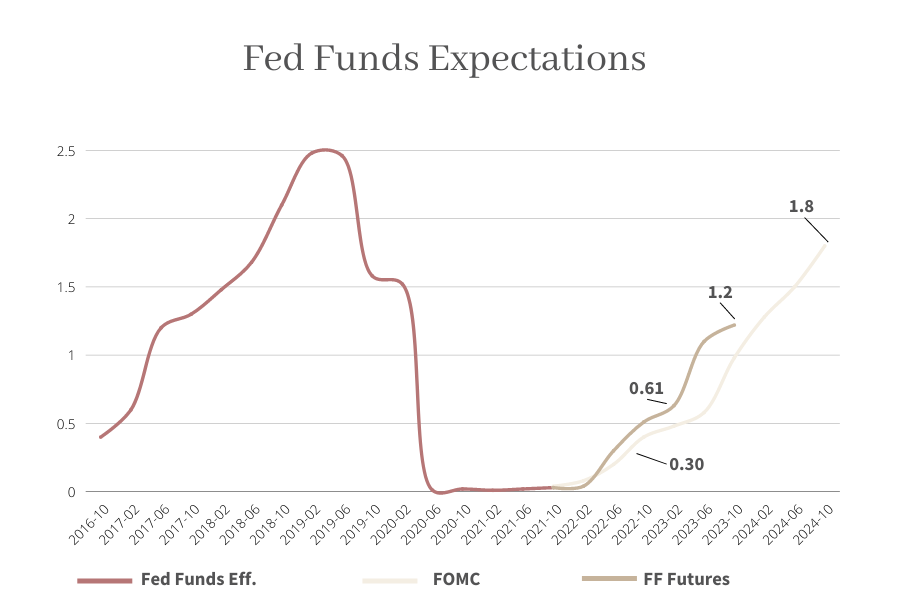

The FOMC meets eight times a year, roughly every six weeks, to do just that - tweak monetary policy in the direction they see fit for the current economy. What they are tweaking can be referred to as the “fed rate”

The federal funds rate is the rate U.S. financial institutions (such as banks, credit unions, and others in the Federal Reserve system) charge each other for overnight loans of reserves deposited at the Fed. The federal funds rate sets the floor for all other interest rates on government and private debt.

While the Fed Rate does not determine the mortgage rate, you can see how the Fed and the mortgage market could move like dance partners. The mortgage rate is reacting to the federal rate.

Mortgage rates usually drift in the direction that the Fed is expected to move.

At the same time, mortgage rates move up and down daily in reaction to the ebb and flow of the U.S. and global economies, which are the same developments that the Fed responds to.

It’s like “same same but different”....... Clear as mud? 🥴

So here's how it breaks down…

When the Federal Reserve makes it more expensive for banks to borrow by targeting a higher federal funds rate, the banks in turn pass on the higher costs to their customers. Interest rates on consumer borrowing, including mortgage rates, tend to go up. Mortgage lenders set interest rates based on their expectations for future inflation and interest rates.

Let's take a look at the history of the dance between the two.

*Que Bridgerton String Quartet Soundtrack

There is a direct link between inflation and mortgage rates, as homeowners in the early 1980s experienced. At that time, high inflation led to some of the highest mortgage rates ever: more than 17% for 30-year mortgages

And here are complaining about 5.5% 🥴

The Federal Reserve aims to maintain economic stability, and manipulation affects bank lending rates. When the Fed wants to boost the economy, it typically becomes less expensive to take out a mortgage. On the flip side, when the Fed needs to slow inflation, it acts to drain liquidity from the financial system (think lack of cash), which typically results in a higher interest rate on mortgages.

Which is exactly what you see in these two graphs - the mortgage rate correlates with the federal rate even though the Fed has nothing to do with determining mortgage rate.

Rates have been so heavily manipulated over the past decade so we’ve become accustomed to historically low rates. In all reality, even in this current hike, we haven’t even hit close to average. Ouch.

Trying to stay as objective as possible when it comes to analyzing this data, but that doesn’t mean it doesn’t sting – because it does. The quickness of it all just adds fuel to the fire. Uncertainty can be grueling – and that is exactly why you need to look at the facts.

If you’re looking at history - we’re only planning to go up in interest rates to recover from our over inflation the pandemic has caused. Only after we’ve seen “ a cooling off” period will we see rates drop.

The Fed’s benchmark interest rate was raised by 0.5 percentage points to a target rate range of between 0.75% and 1%. The hike is the largest since 2000 and follows a .25% point increase in March, the first increase since December 2018.

More rate rises are expected. The Economist Intelligence Unit expects the Fed to raise rates seven times in 2022, reaching 2.9% in early 2023. Starting in June, officials also plan to shrink their asset portfolio (liquifying cash), a policy move that will further push up borrowing costs.

A “cooling off” period is sure on our horizon, but keep in mind that it doesn’t mean home prices will fall. In fact, every major real estate firm that has shared their research publically, including the Mortgage Bankers Association and CoreLogic, still predict home prices to rise over the coming 12 months.

Why?

Lack of inventory.

Once inventory catches up, it could be a whole other ball game – that is just not the case right now. Albeit rising levels (🙌🏻) – nowhere near balanced.

So what matters to you right now?

If you are thinking about selling + buying – I would highly recommend getting in the game. With interest rates literally all over the place…time is money. If we learned anything from 2020 (other than the proper hand washing hygiene), it’s that real estate is the greatest hedge against inflation.

Let’s get you on the right side of it.