Recession vs. Crash

Tell me if you might be feeling like this little bird when it comes to the real estate market…

Frankly I’m not even sure what kind of bird it is…he’s so beat up! Losing all his feathers..and looking like he needs a hug.

Not unlike today’s buyers. 🥴

You are seen, heard, and if I was sitting in front of you right now – I’d give you the biggest hug.

And because we fight fear with facts over here….I’m going to give it to you straight.

It seems that when we hear the word “recession” we automatically think “HOUSING MARKET CRASH” and why wouldn’t we?

Our last major experience with a recession resulted in a housing market crash in 2008 – Because the recession was caused by the housing market.

I am here with good news for you today! They are not the same. And here is why.

Here are 3 Key Differences between a Recession + a Crash

The two words have been used interchangeably by homeowners… and the fact is – they are just not the same.

If we take the birds eye view of the economy, an actual Recession is generally no more likely to create significant housing downturns than any other movement in the economy.

What is a recession?

re·ces·sion

/rəˈseSH(ə)n/

An economic recession is defined as a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters.

With the rise in gasoline prices + oil prices, experts have been predicting a recession for a while.

Economic downturns can, of course, result in market factors that stress the housing market, from increased unemployment to decreased demand as families decide to stay put and ride it out. However, historically there is little correlation between recessions and a decline in housing prices.

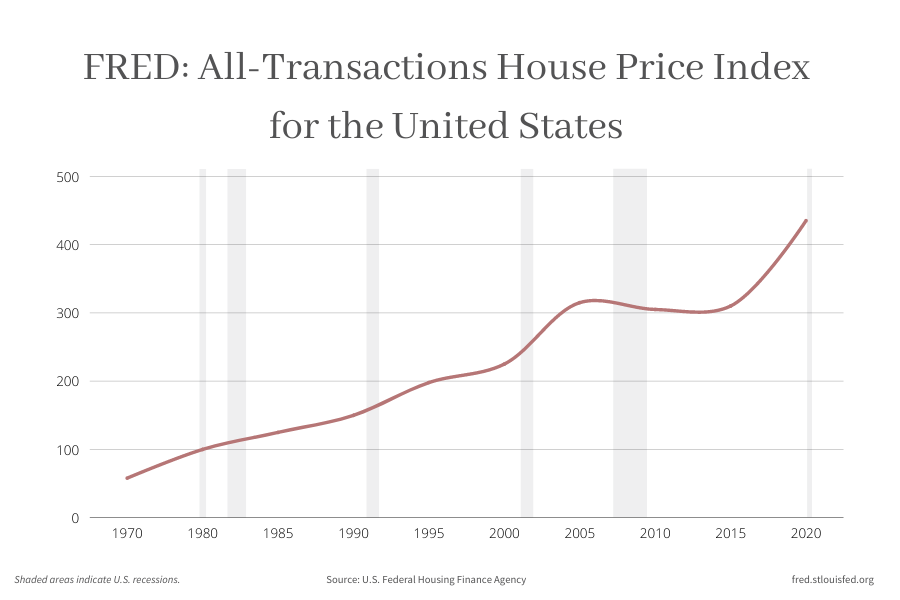

Looking back over the last four decades, there have been a handful of separate recessions. Looking at housing prices during the same periods, you’ll see the following changes.

1980: -2.6%

1981-82: -5.8%

1990-91: -6.7%

2001: +4.4%

2007-09: -16.7%

You’ll see in most cases, home prices withstood normal market activity – meaning their pricing fluctuated as it should. Small decreases like this will bounce back over time.

And then there is 2007-2009 rearing its ugly negative 16.7%.

What was the difference between other recessions and 2008?

The recession was centered around the real estate market. Underlying causes of the down turn were based on housing + home prices being affected.

Here are a few that will effectively cause a “Crash”

⛔️Adjustable Rate Mortgages & Subprime Lending Requirements - Adjustable loans were granted to less-qualified borrowers who were more at risk of defaulting through job loss and/or financial status.

⛔️An Over Supply of Inventory - The 2007-2008 Market had 4x the inventory we do now.

⛔️Minimal Down Payments - The 2007 market was filled with hefty mortgages with little to no down payments…on multiple homes. Primary’s, secondarys, + investments.

Here is the good news.

Our market literally has none of those things.

✅ Stricter Lending Requirements - Lending requirements have actually increased since the crash in 2008 meaning it’s not as easy

✅ Low Inventory/High Demand - We have actually never seen inventory levels this low….like ever 😳 creating rise in demand.

✅ More Money at the Closing Table - The average down payment is actually an average of 15% down and only growing with the rise in equity.

So why is the go to thought — thinking the market is going to crash?

History.

Our latest experience with a recession was the Great Recession in 2008 that was caused by bad loans + poor lending requirements. That is what caused the crash of the housing market.

A recession doesn’t have to be scary as long as you're prepared. Think of it like a pressure cooker - The Fed is raising the federal rate so that some of the pressure is let out of the pot (slow down spending). And let's be real….we need that release

One thing that could pose a problem for the housing market during the recession is the high unemployment rates. This will reduce borrowers ability to purchase a home thus increasing the demand further.

“The reality is home prices and existing home sales don’t necessarily decline just because of a recession. In fact, the housing market actually benefits in one specific way during a recession: Monetary policy is usually eased to boost the economy, often leading to falling mortgage rates, which increases consumer home buying power and makes homes more affordable.” – Odeta Kushi, Deputy Chief Economist - First American Title

Where we are seeing a tightening of the lid, that lid will ultimately come loose. I see some refinances in the years to come.

And for those that bought before rates hit an all time high – you will be rewarded when it comes to refinancing in a few years. Prices will increase + your rate will decrease over time.

So what’s best for you now?

As far as if now is a good time to buy or not – I would take a look at your goals. Knowing what you know now about the market, if you see yourself buying in the next 1-2 years I would say time is money and if you can make it work as soon as possible – I would see what that looks like for you and your family.

The home you end up in might not be what you had in mind…but it puts you in the game. Focus on the opportunity.

If it’s not really on your radar for 3-5 years then just sit tight & live your life. The market will be ready when you are. As always – we are here to guide you, advise you, and ultimately be the go to page for all your real estate questions.

Thanks for being here!