The Cost Of Waiting: How Interest Rate Increases Affect Your Payment

Raise your hand if you’re sick of hearing “But rates are actually historically low….”

Good. Me too.

Because quite frankly – it’s really hard to relate to interest rates that were around in the 80’s. It’s just not relevant any more.

What you’re more interested in is how this affects you…now.

I received some of the best information the other day from one of my preferred lenders. She said – the conversation needs to be about payment…not interest rate.

Because the interest rate is irrelevant. You live in the payment.

She also gave the greatest analogy.

You’re married to the house. You’re dating the interest rate.

It was so simple– interest rates can change. And pretty simply.

NowI get it - you’re like Kelley, have you seen the rate increases?!! How does that affect my payment?!

Let me explain.

Let’s take a .5% interest rate hike. How does that affect your payment?

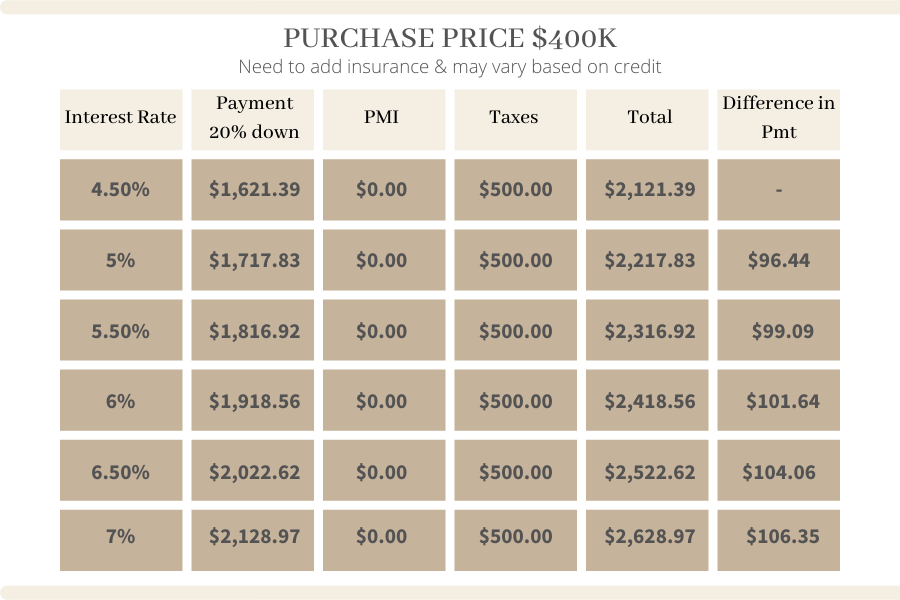

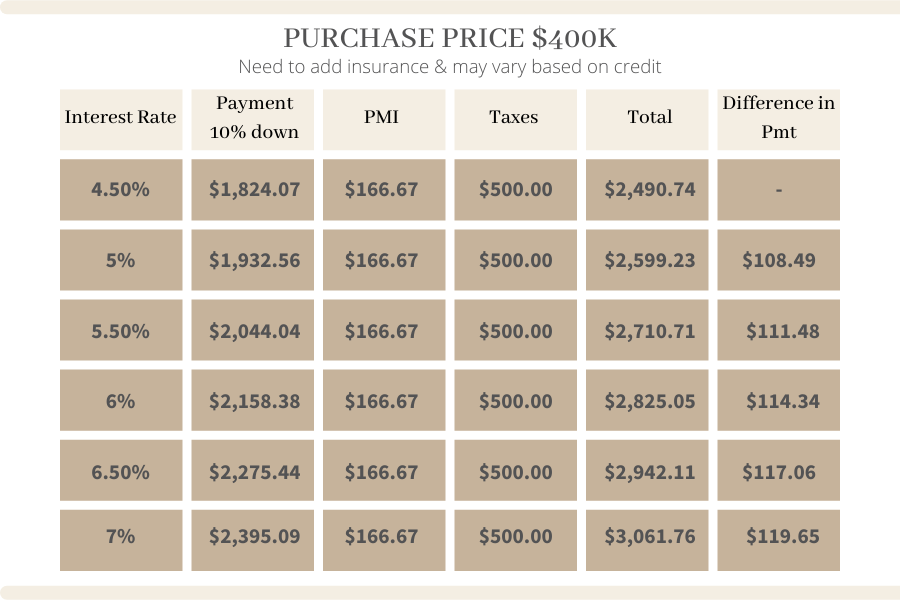

We’ve broken them down into three different scenarios based on down payment - 20% down, 10% down & a 5% down payment.

All these charts will be based on $400,000 purchase price – Billings avg price for a single family home.

Keep in mind that rates & mortgage insurance changes based on credit score + these numbers do not include insurance.

At 20% down – a .5% increase in rate shows an increase in payment $100. We are forecasting into seeing rates in the 7’s by the end of the year – so the cost of waiting with 20% down could be up to $200 per month in rate alone. (6% increased to 7%)

Looking at the 10% down option – that difference only grows.

The difference between 6% & 7% is just over $350.

And now the 5% – you see where this is going. The difference between 6% and 7% is $370.

People often want to know the cost of waiting….there you have it.

Okay now time for some good news – these rates will come back down. Our Federal Reserve is way too manipulated right now. Once inflation cools off – these rates will come back down to aid those priced out of the market.

Then would be the time to refi.

Prices will continue to go up for the rest of the year – demand drives that and we are not seeing demand slow down at all.

Buyers will take it in the shorts for a little while when it comes to interest rate – but those who decided to move forward in this market will be rewarded when we come out of it.

Remember when we used to think 5% was an outrageous interest rate – wouldn’t you be pumped about a 5% interest rate now??

It will be the same feeling for those who waited to buy – early adopters get rewarded.

Be an early adopter.